food tax in pakistan

WfpSaiyna Bashir World Food Program USA Statement on Pakistan Flooding. However there are some.

Pakistan Personal Income Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

Personal Income Tax Rate in Pakistan averaged 2167 percent from 2006 until 2020 reaching an all time high of 35 percent.

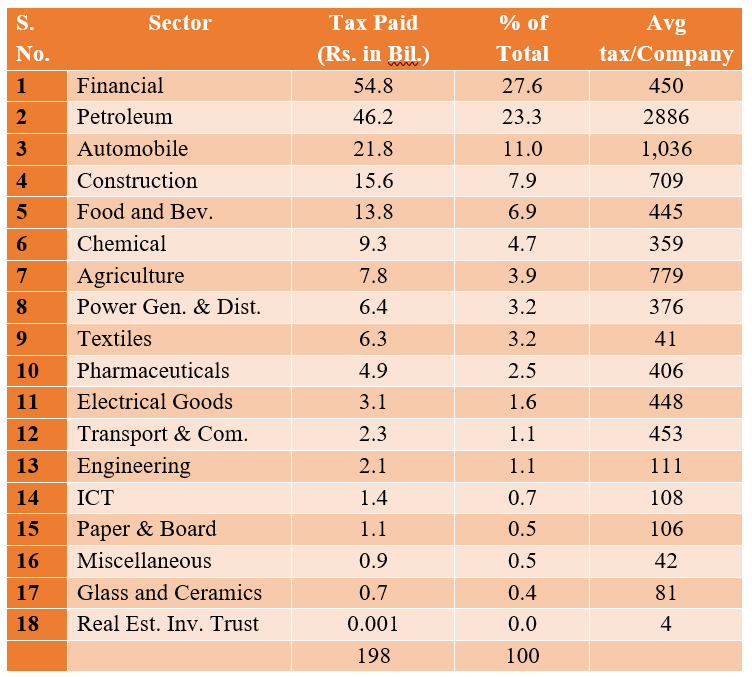

. October 19 2021. The standard rate of GST in Pakistan is 17. Income Tax is one of the important sources through which a government.

The standard sales tax rate in Pakistan is 17. The Personal Income Tax Rate in Pakistan stands at 35 percent. GST is a value added tax VAT used in Pakistan.

Sales Tax is a tax levied by the Federal Government under the Sales. However contrary to that Pakistans tax base has shrunk 17 in the 2016. October 19 2021.

The World Food Programme estimates that approximately 43 per cent of Pakistans population is food insecure and the main reason for malnutrition is an acute. Tax on value of capital assets in Pakistan. Income Tax is paid by wage earners ie salaried class self-employed and non-incorporated firms.

According to the media a meeting to review the rising inflation and the. In certain casessectors turnover tax is paid at rates lower than 125. 8 rows Sales tax rates in Pakistan.

Knowledge of basic concepts would not only ensure that the tasks are performed easily but also in the prescribed manner. Minimum tax on turnover Depending on the situation and industry such turnover tax may be charged at rates lower than 125 percent ranging from 025 percent to 075 percent. Since 2013 drought has become a frequent phenomenon in Pakistan affecting livelihoods and household food security in parts ofBalochistan and Sindh provinces the UN.

World Food Programme is rapidly. Eggs honey and milk. Five million in the last twelve months.

The rate for sales tax is 16 of value of supplies. The government has decided to reduce taxes on the prices of food items amid rising inflation sources told Geo News on Monday. Pakistan government has decided to reduce taxes on the prices of food items.

For companies that owe a tax of less than 125 of their turnover 125 of their turnover must be paid as a minimum tax. ISLAMABAD The Federal Board of Revenue FBR has increased sales tax rate on supply of food stuff by restaurants bakeries caterers and sweetmeats shops to 17. A resident person owning immovable property in Pakistan will be taxed on deemed income for tax year 2022 and onwards.

The growing number of food outlets and restaurants should have helped the FBR widen the tax net. Imports of some basic foodstuffs and agricultural supplies are exempt from import Sales Tax. Fish meat and fillets.

Private Limited companies in Pakistan Live animal. Exporters and certain providers of financial services may apply for a Sales Tax suspension. Use the calculator below to find values with and without GST.

Similar exemption is also available to retailers having total turnover below Rs. But one also needs to look into those goods or services which are exempt from tax. Following the Government of Pakistans request for support the UN.

Goods and Services Tax on food services in India can be 5 12 or 18 depending on a variety of factors including but not limited to type of establishment and.

Afghan Food Prices Soar As Imports From Pakistan Squeezed Nikkei Asia

Salem City Council Marijuana Grow Zones Tax Abatement Approved

Vat Faqs E Fbr Gov Pk E Fbr Inland Revenue

Haq S Musings Pakistan S Tax Evasion Fosters Foreign Aid Dependence

Cities Pay Taxes Pide Blog All

Haq S Musings Pakistan S Tax Evasion Fosters Foreign Aid Dependence

Taxes Galore Pakistan To Double Sugar Taxation As Part Of Effort To Secure Imf Bailout Funds

Pdf Empirical Investigation Of The Factors Affecting Firm S Performance A Study Based On Food Sector Of Pakistan Semantic Scholar

Fiscal Reforms In Pakistan By Dr Hafiz A Pasha Prepared For The Workshop On South Asia Tax Systems 8 9 August 2010 Singapore Dr Pasha Is Ppt Download

Fbr Clarifies 17 Sales Tax On Bakeries Restaurants And Other Items Ig News

General Sales Taxes And Gross Receipts Taxes Urban Institute

How To File Income Tax Return In Pakistan Be Taxfiler

Sin Taxes Work While Stealth Reformulation Success Still Anecdotal Says Study

Debt Taxes And Inflation Highlights From The Last 10 Years Of Pakistan S Economy Dawn Com

Photos At Taste Of Pakistan Pakistani Restaurant

Govt Plans To Rationalise Duties Taxes On Food Items Business Recorder

Sales Tax Rates Updated On Services Provided By Restaurants Pkrevenue Com